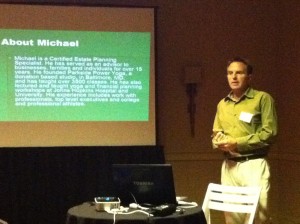

Michael Thomas currently writes the Money Matters Column for Find Bliss Magazine. He is a Certified Estate and Trust Specialist, a Yoga Instructor, and a former Yoga Studio Owner. He has served as a financial advisor to individuals, families, and businesses for over 15 years and has taught thousands of classes and workshops and has a letter of recommendation from Johns Hopkins Medical Center where he has conducted financial workshops and taught yoga. He brings a level of experience to financial, estate planning and coaching that are unique, insightful and powerful.

THE 15 AREAS OF ESTATE PLANNING

In the planning process, experience has shown that there are fifteen of estate planning that should be addressed in order to develop a sound foundation for designing an estate plan. These are: Supplemental Planning, Settlement, Cost, Money Management, Guardianship, Distribution, Asset Protection, Estate Reduction & Freezing, Asset Allocation & Conservation, Income Tax Planning, Social Capital, Insurance Planning, Retirement Distribution, Business Succession, and Medicaid Planning.

1. Supplemental Planning. Supplemental planning consists of ancillary planning strategies to cover events that may occur prior to one’s death. These documents are:

a. Durable Power of Attorney

b. Advanced Health Care Directive / Living Will (Terry Shiavo)

c. Organ Donation

d. Advanced Health Care Decision for Minor Children

e. Nomination of Conservator

f. Medicaid Planning

2. Settlement. At death, there is a tremendous amount of paperwork required in a short period of time. It’s important to eliminate most of the paperwork while you are alive and minimize the rest.

3. Cost. Unfortunately, death can sometimes be costly. Some costs can be eliminated and others minimized, such as federal estate taxes, state inheritance taxes & probate.

4. Money Management. Money Management for estate planning purposes relates to the establishment of a management team to assist your surviving spouse or heirs in the management of your assets after your death.

5. Guardianship. If both parents pass with no planning leaving behind children under the age of 18 or a child who is above 18 and has been deemed unable to care for oneself by the state, guardianship issues may arise. With no planning, for example, the state will appoint a person (maybe someone whom you did not intend to be the guardian) who will be the guardian of the minor as well as a person to be guardian of the estate (money). The guardian’s responsibility is to take care of the minor children; showing love, affection and providing support and safeguarding. Additionally, the state will appoint a conservator of the estate. This person’s responsibility is to manage the moneys for the minors. If the guardian needs additional money, they have to petition the court, thus generating additional court costs and attorney fees.

The worst part of guardianship occurs when the minor becomes an adult. In many cases, at age 18, they would likely receive their inheritance outright. Most parents believe age 18 is much too young.

6. Distribution. Distribution outlines who gets what, when, and how much; taking into consideration premature death of heirs, divorce and sibling rivalries. These are real life issues that should be addressed but are often overlooked by planners. Unbeknownst to many, distribution requires the most effort in designing an estate plan.

7. Asset Protection. The most misunderstood part of the planning and often not addressed. It focuses on protecting your assets in the event of a lawsuit. This same planning strategy can also be used to protect assets for future generations

8. Estate Reduction and Freezing. Often times you cannot control the growth of an asset. Estate freezing is to allocate assets so that the growth takes place away from the estate rather than in it. Additional planning strategies can reduce the value of an estate; thus, reducing the impact of estate taxes.

9. Asset Allocation & Conservation. Asset allocation identifies assets to be sold to pay debts or federal estate taxes without incurring additional income tax. Conservation is accomplished by preselecting assets to retain for future generations.

10. Income Tax Planning. Establishing a qualified plan to receive tax deductible contributions to reduce your current income tax on excessive income not being used to live on.

11. Social Capital. The portion of the estate that is paid to Uncle Sam in the form of estate and income tax. In 1969, the IRS authorized a special type of trust that gives the taxpayer a choice in redirecting social capital (estate/income taxes) to a worthwhile charitable organization in the community.

12. Insurance Planning. A). Long Term Care: largest segment of aged 50+ individuals in U.S. history. B). Umbrella insurance: O.J. Simpson. C). Health insurance: a long term illness could wipe out savings. D). a greater chance of disability than death. E). Life Insurance: income replacement, estate taxes, eliminate debt, and etc.

13. Retirement Distribution. Exploring the different strategies available that can prolong the distribution of retirement assets for multiple generations to reduce income tax.

14. Business Succession. There are over 500 different combinations in transitioning out of a business. Knowing the difference between time and timing is very important. A) Time – preparing the business and its owner for the transition; b) Timing – transitioning out of the business when the business has obtained its optimum value.

15. Medicaid Planning: Prepare an estate plan to preserve as much of one’s estate in case Medicaid planning is needed.